The invidis industry index DBCI is back with exclusive industry insights. Up until 2017, invidis surveyed the industry sentiment (archive with all results) for almost ten years using the Digital Signage Business Climate Index (DBCI). Now the index is back and the first survey already brings very interesting insights into the state of the digital signage industry in EMEA and North America.

The Current Situation

The current mood in the industry is very good – this could also be experienced on the show floor at ISE 2023. A total of 86 leading digital signage providers from Europe (80%) and North America (20%) took part in the survey in early January 2023. With an index value of 56.5 (scale from -100 to +100), the sentiment at the beginning of the first quarter is very good.

Historically, the industry achieves the highest sales in the last and first quarter of each year. Current sentiment is best in North America, followed by the UK, Benelux, DACH and Scandinavia. Industry sentiment is lagging behind particularly in Italy and on the Iberian Peninsula.

The outlook

The six-month outlook remains positive, although expectations are a bit more muted compared to the status quo. The exception is France, where expectations for the coming six months are higher than the current business situation. In discussions with invidis, French digital signage players are setting high hopes on the upcoming 2024 Summer Olympics in Paris. Many luxury brands are renovating their flagship stores in Paris for the summer games. The next quarterly DBCI surveys will show whether the special demand will really materialise. Expectations for the next six months are the highest in North America.

The analysis of the individual digital signage business types in the value chain are also interesting.

Integrators report the most positive signals – both about the current situation and the outlook. Since integrators usually own the end-customer lead, the industry can except more positive business. Exhibitors and trade visitors at the ISE also reported an enormously increased interest from end customers in digital signage solutions.

The DooH industry, which is struggling with the current advertising crisis despite an increase in market share, is in a somewhat less positive mood. Independent Software Vendors (ISVs) rated the current market situation most negatively at the beginning of the year.

Challenges

As part of the DBCI, invidis surveyed leading representatives of the digital signage industry about their greatest current challenges.

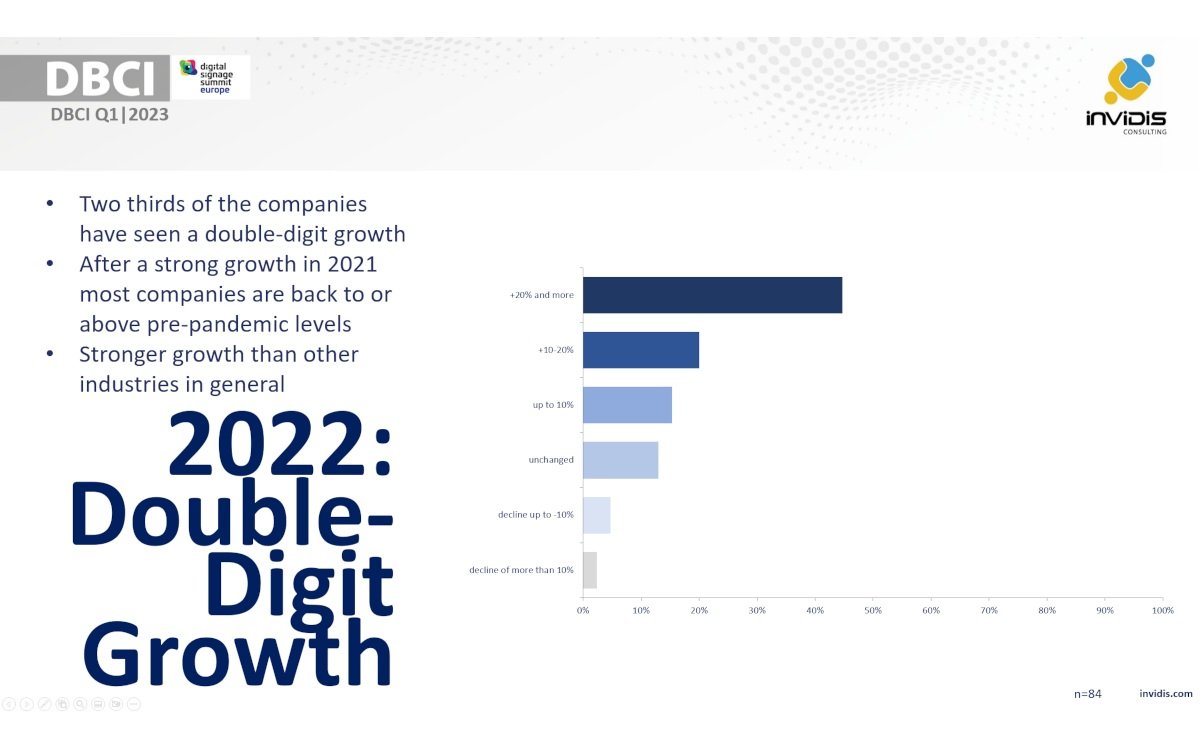

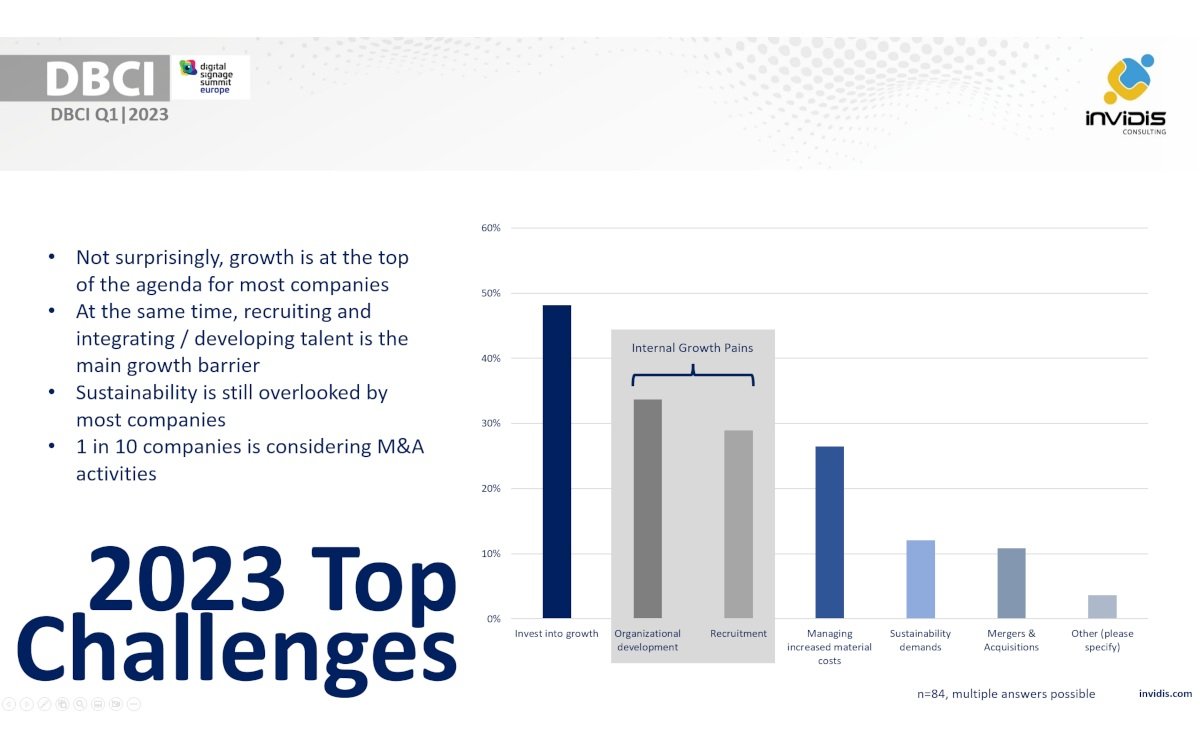

Unsurprisingly in times of double-digit sales growth, the biggest challenge is adjusting corporate structures to meet rapidly growing demand. In addition to adapting internal structures (including back-to-office vs.work from home), the search for new employees that is proving to be particularly difficult, not only in the digital signage industry.

More than a quarter of all digital signage providers surveyed see rising material costs as one of the biggest challenges, followed by green signage and sustainability topics.

Detailed results of the index are available as a PDF download.

The next DBCI survey will be conducted in early April, results will be published in mid-April.

Background DBCI

The invidis DBCI is based on leading industry indices and will be expanded to become a fully compatible PMI index (Purchase Manager Index) in spring 2023. With quarterly vs. monthly surveys, we avoid the high month-to-month fluctuations that are typical for the project business. The index is collected and evaluated by invidis independently and in accordance with European data protection regulations.

We publish the results free of charge as an information service for the industry.

In order to cover the costs of the index, we are looking for a name sponsor who will financially support invidis in conducting the index for at least one year. (Contact: Florian Rotberg)

Digital Signage businesses wishing to participate in the survey should contact Daniel.Oelker@invidis.com