invidis Yearbook: Digital Signage Integrators | Follow the customer

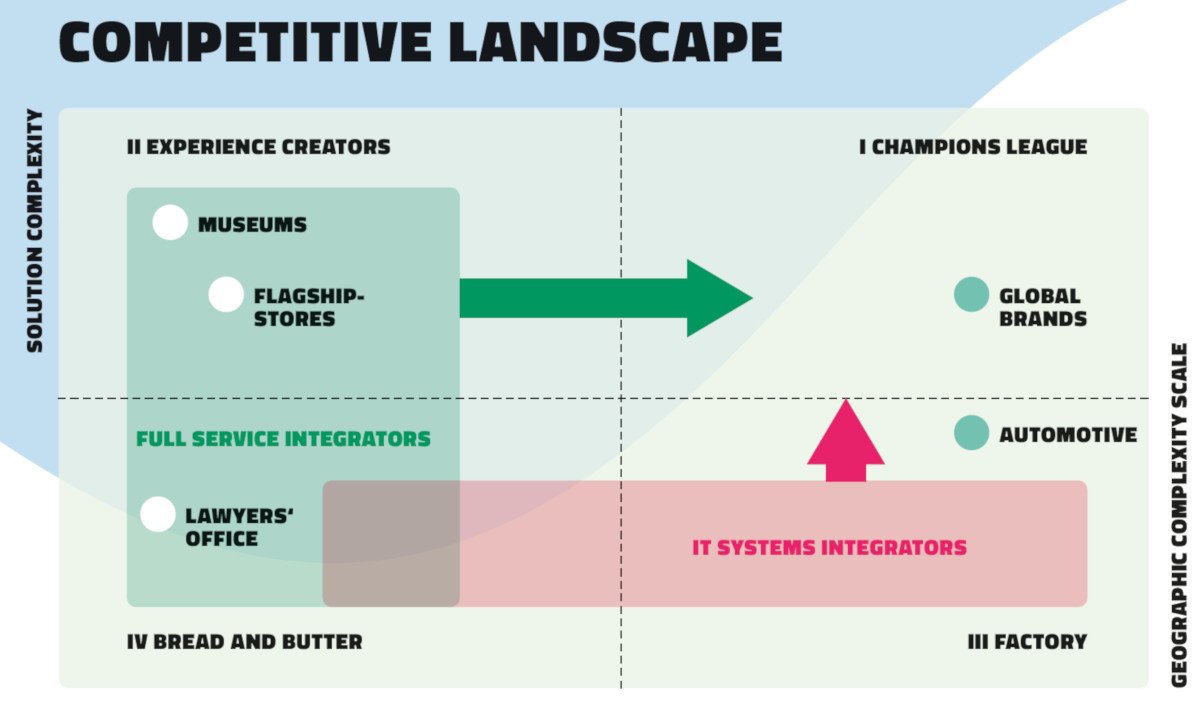

As far as system integrators are concerned, the consolidation of the digital signage industry is continuing. Nevertheless, it is not only global players that are winning tenders. Regional players can also compete successfully. It is also striking that classical integrators are no longer the only ones active in this market sector.

Local partners are still in demand despite the fact that large providers are increasingly emerging due to industry consolidation. The relationships between small integrators and their customers – which have often grown over the years – have ensured that tailor-made concepts can beb tailored to customer needs. Larger international projects are also handled by local partners. The strategy is simple: Follow the customer.

But many of these long-standing supplier relationships are increasingly being questioned. As a rule, this is because customers are becoming more professional and, increasingly centralise the purchase of Digital Signage services. Furthermore, customer requirements for Digital Signage concepts (especially 360 ° experiences) are increasing significantly.

Both trends mean that Digital Signage providers are increasingly having to offer complex solutions, with customers increasingly looking for suppliers with experience in major international projects.

It is also striking that two kinds of Digital Signage providers are now facing each other: the established ones, who also build up 360 ° experience skills, and – especially in large international projects – global IT system houses, who are rather inexperienced in the Digital Signage market.

In order to be successful, traditional DS vendors must acquire sufficient 360° experience projects, build up economic competence, and gain greater financial strength in order to win against major IT systems vendors. DS vendors should also take new partners (leasing companies) on board by buying or building ecosystems. For the major IT system houses, the challenge is to build up DS competence, especially for 360 ° concepts and platform solutions, or to acquire them through acquisitions.

This also explains why there has been a lot of movement in the M&A market. Both DS specialists looking for size and IT system houses in search of specialised knowledge. As sad as it may be, there is still no ideal supplier for large corporate customers who can deliver both size and competence on a global scale.

In recent years, more and more global consulting firms and agencies have entered the Digital Signage market. The question then arises as to why global consulting firms such as Accenture – with an annual turnover of 29 billion euros (half of which is digital sales) – are dealing with the relatively small Digital Signage market. The answer is simple: Customers are looking for trusted names and experts to guide them through the technological jungle. Large worldwide consultancies bring with them a leap of faith in terms of competence, but have the necessary size from the customer’s point of view. As a solutions business, Digital Signage is by no means an off-the-shelf product, but a complex tailor-made platform. The fact that global players have so far not been very successful on the market is due to the complexity of Digital Signage, which is often grossly underestimated. Technology and data meet marketing and creative processes.

But the gaps are closing with global providers as well as with the predominantly nationally active Digital Signage integrators. They can be divided into four types: pure players (full-service system integrators), AV integrators (technical integrators, usually with limited conceptual and content competence), IT system houses and others (including content agencies, Business consulting and B2B backend providers).

Main Consolidation Trends

- Establishing of End-to-End Supplier (e.g. Stratacache/Scala)

- Geographical Reach (e.g. Zeta-Display in Nordics and now expanding to BeNeLux)

- New Market Entries (Adobe-Experience-Manager, Consulting Firms, Agency Groups, B2B-Backend-Provider, Shopfitter)

- Simple Signage (scalable digital poster networks) vs. Full Experience (360°-Experience, Omnichannel)

In addition to global consolidation trends, the market’s own drivers play a role in the consolidation of the European digital signage industry. Between April 2017 and March 2018 invidis consulting counted more than 50 acquisitions in the most important European markets. The Munich-based consulting firm has identified follwong drivers for M&A:

Five Drivers for M&A

- Capability Expansion – No survival of one-trick ponies (Installation, Instore Music, IoT, LED)

- Category Expertise (Specialist for vertical markets)

- Critical Mass (Software installed base, Operations)

- Geographic Coverage (cross-border, Pan-European and Global player)

- Buying Business (reducing dependency from top customers, bulk risk)

Relevant IT systems integrators and agencies with digital signage business units | Total Revenue 2017 in EUR (Top Digital Signage Customers)

- Accenture Digital | 29bn EUR (Daimler)

- Atos | 13bn EUR (McDonalds ->2017, Sephora)

- CapGemini | 12,8bn EUR (McDonalds)

- T-Systems | 6,9bn EUR (BMW)

- Arvato | 3,8bn EUR (Audi)

- Ceconomy – a spin-off of Metro Group / xplace | 22bn EUR (Porsche)

- Econocom | 2,9bn EUR (Caverin)

- Arcadis | 3,2bn EUR

- Publicis Pixelpark | 9,69bn EUR