The Swedish digital signage provider Vertiseit (Grassfish, Dise) starts the new year with another transaction. In a mixed cash and share transaction, Vertiseit has signed irrevocable agreements with 47% of MultiQ shareholders, with a public offer to acquire 100%. MultiQ is listed on the Nasdaq Stockholm stock exchange. Vertiseit is particularly interested in the company’s substantial software business of approximately 30,000 software licences and license revenue exceeding €5m ARR.

MultiQ is one of the lesser-known digital signage providers outside Scandinavia; although the company based in Lund / southern Sweden is one of the pioneers in the industry. Early on, the Swedes set their sights on consolidation and took over, among others, Mermaid, the most important Danish Digital Signage provider at the time, and Headline.TV from Norway, a leading CMS expert.

However, MultiQ – which in addition to full-service digital signage services – is also a display manufacturer for special applications within the transportation and gaming verticals.

In recent years, MultiQ had a hard time keeping up with the rapidly growing Digital Signage market. Sales have been around €13-15m annually since 2016, with the exception of one peak in 2019 (€24m).

MultiQ is known in the DACH region for its close partnership with the Swiss market leader JLS Digital (Swisscom), which operates a good third of the 30,000 active MultiQ SaaS licences. The face of MultiQ in the DACH region is Sales Director Daniel Bloch, a former Scala developer and HeadlineTV founder who speaks fluent German and is largely responsible for the success in Germany and Switzerland. Until moving to Grassfish, Telefonica Germany (O2) was also one of MultiQ CMS’s largest clients.

MultiQ is particularly strong in the verticals public transport in Denmark and in lottery and gaming terminals in Scandinavia and North America. The company generates almost 80% of its sales in Sweden, Denmark and Norway among others with partner Telia. Besides JLS Digital, the most important partners outside Scandinavia is the American gaming and lottery company Scientific Games.

Vertiseit is particularly interested in MultiQ’s CMS business – with five million euros in recurring revenues, certainly the highlight of the balance sheet.

Strategies: Vertiseit different route to conquer global markets

While the big European integrators – Trison, ZetaDisplays and M-Cube – are using acquisitions to increase their European and global concept and service footprint, Vertiseit is going platform-first and builds on increasing its installed software base. Further potential acquisition targets are pure Digital Signage CMS software vendors and the platform business of established integrators.

Software is a scale business – the larger the installed base, the better development costs can be spread. In addition, the trend is clearly moving towards subscription models (recurring). Many smaller – often regional – Digital Signage CMS providers have therefore already had to give up. At the same time, the large international providers are gaining in importance. The largest provider (Stratacache/Scala) has an installed base of over three million licences, however only a portion with a subscription and SaaS model.

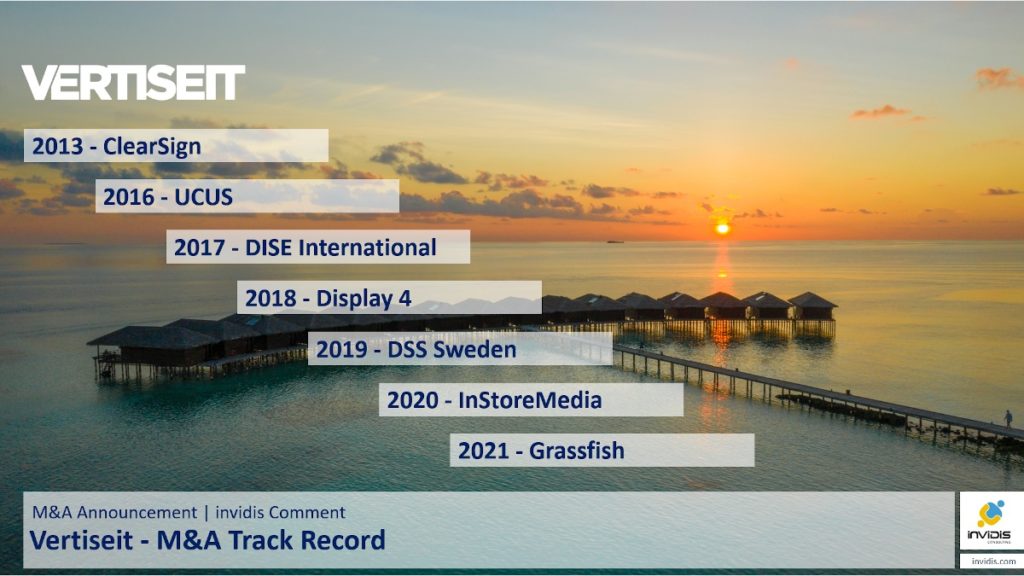

Vertiseit has been playing in the league of the big CMS providers since the takeover of Grassfish in May 2021. With 100,000 active licences and the equivalent of 6 million euros ARR (Annual Recurring Revenue), Vertiseit is one of the largest recurring CMS providers in Europe. By acquiring MultiQ, Vertiseit adds another 5 million euros ARR. Making the company the market leading software company within Digital Signage in Scandinavia and the DACH region with a calculated 12 million euros ARR and 130,000 active digital signage licences. Vertiseit plans to achieve an ARR of 20 million euros by 2024 – an ambitious goal that likely will require further acquisitions.

Vertiseit has been high valued on the stock exchange since the summer of 2021, a takeover currency that CEO Johan Lind knows how to use. Other digital signage providers in Europe and North America are on his bucket list. Since the market of attractive Digital Signage CMS-only companies is short, Vertiseit is increasingly seeking contact with integrators who lack the perspective, capital and installed base to further develop their own software.

Further transactions – even those that seem unusual at first glance, such as MultiQ – are on Vertiseit’s agenda for 2022.