Madrid | The new year begins as 2021 ends. The order books of the digital signage industry are full to the brim and the warehouses are completely empty due to delivery bottlenecks. However, some digital signage integrators have taken precautions and are therefore fully able to deliver in the coming months.

Luckily, those who currently have a high level of liquidity and good access to suppliers. Like the Spanish company Trison, Europe’s largest digital signage provider. Thanks to major customers like Zara, Porsche and C&A, the integrator from La Coruna can plan well for display, LED and media player demand in the coming year. Whether Samsung displays or Absen LED. Trison has taken precautions and stocked up its warehouses throughout Europe. At their own, but manageable risk. In times of crisis, it pays off to have a global customer base and a solid distribution network. The business model of pan-European integrators with a strong balance sheet proves their worth.

A luxury that most smaller integrators can hardly afford. Even as demand goes through the roof across the industry, most integrators struggle to stock up essential hardware.

“Putting the customer first is always the right strategy in the long term. Every crisis accelerates and intensifies existing trends like digitalization, and supply chain shortages won’t stop this strategic move in leading companies”, so Trison Group CEO Alberto Cáceres in a personal meeting in Madrid to invidis.

It’s jammed in almost every corner – relief not expected until mid-2022 at the earliest

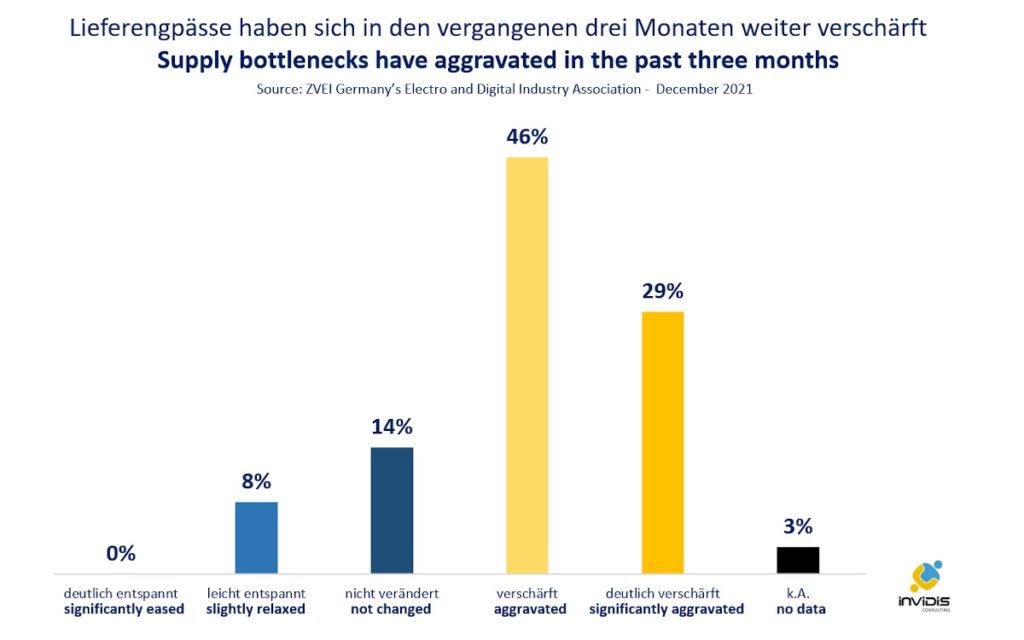

Supply chains are stretched to breaking point. Almost all companies in the German electrical and digital industry continue to face material shortages and supply bottlenecks. This was the result of a recent German Electro and Digital Industry Association (ZVEI) member survey. „For three quarters of the companies surveyed, the situation has worsened in the past three months – for one third even significantly,“ said Wolfgang Weber, Chairman of the ZVEI Executive Board. Meanwhile, a rapid end to the shortages is not in sight: around half of the companies expect the current situation to continue until the middle of next year. The other half expect the situation to remain tense beyond that.

Processors are complicated to manufacture, taking up to nine months to produce and often requiring hundreds of materials such as copper, tin, cobalt, hyperpure silicon or hydrochloric acid and thousands of steps. A supply chain in the chip industry can include up to 16,000 companies, according to a recent FAZ article.

Difficulties currently exist in the B2B supply chain in particular. In addition, the situation is also exacerbated by oversubscribed customer ordersi: „About half of our member companies perceive that their customers are ordering more than is needed. One sixth even to a high degree. But it is not only customers who behave in this way. Two-thirds of companies in the electrical and digital industries also feel compelled to place more orders in order to avoid shortages as far as possible,“ says Weber. To better prepare for future bottlenecks, companies are primarily focusing on diversifying supply chains (69%), more stockpiling (65%) and more long-term supply contracts (45%).

Sales could have been up to 10 percent higher in 2021

Surveyed companies even estimate that this year’s sales could have been up to ten percent higher without the shortages and logistics problems. At present, production is lagging well behind the development in incoming orders – which were more than a quarter up on the previous year in the first three quarters of 2021. The ZVEI is sticking to its forecast from the summer and expects production to increase by eight percent this year. This could more than make up for the pandemic-related production decline of six percent last year.