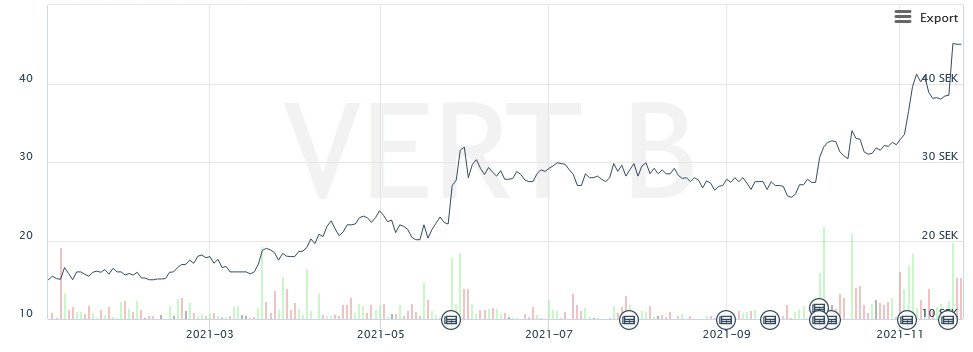

Vertiseit’s share price has risen an incredible 224% since the beginning of the year. With only 15 million euros in sales, the Swedish digital signage provider is currently valued at an incredible 93 million euros (Link) – with a multiple comparable to Silicon Valley tech platforms such as Salesforce or Adobe. invidis analyzes and explains the effects on the digital signage industry.

Valuations of digital signage market players in the context of M&A are a complex and often highly emotional matter. Company valuations are usually based on EBITDA multiples with premiums for particularly long-running recurring revenues and risk discounts for high customer concentration. Dozens of other metrics can be applied in the sales process.

Not so with the few publicly traded companies – here valuation is simple. Market capitalization – stock price times number of shares – can be determined at the stock market on a daily basis. Whether this valuation can actually be realized in a takeover or outright sale, or even at a premium, is another matter, however.

Historically, multiples of between 7 and 12 have been paid for digital signage integrators. Software providers with a solid SaaS business model tend to be at the upper end of the valuation scale, or even slightly above, due to the higher proportion of recurring revenues.

How can a valuation like Vertiseit’s currently be explained and can any integrator or CMS vendor now expect a multi-million exit?

While we would wish high valuation for any brave and self-sacrificing digital signage entrepreneur, such high valuations are probably the exception rather than the rule. Certainly, there is a lot of private equity capital in the market right now. Moreover, with double-digit growth rates, the digital signage indsutry continues to offer an attractive market environment for investors in the years to come. In addition, the market consolidation taking place is driving demand for attractive targets. All factors driving multiples upwards.

A purely mathematical view will also lead to arithmetically higher multiples, at least in the short term, as earnings of many industry players have declined or remained stable in the last two years compared with pre-COVID times. This lower EBITDA base ensures higher multiples even if purchase prices remain constant.

On the other hand, interested buyers, especially if they are strategic investors, will not detach themselves from any basic economic logic. After all, it must be possible to generate the profits that ultimately justify the purchase price. In addition, the „story“ and the timing for a subsequent resale or stock market exit must also be right. The increased uncertainty caused by the pandemic and the associated effects, e.g. on the supply chain, also play a role. All factors that tend to dampen the willingness to pay high multiples.

Therefore, exaggerated purchase price fantasies are more likely to be a hindrance than a goal. In particular, companies for which the next growth step in the form of a sale or merger is imminent must weigh very carefully whether maximizing the purchase price or the future of the company are more important.

Overall, we will probably see rising multiples in the future, but also rather moderate increases.

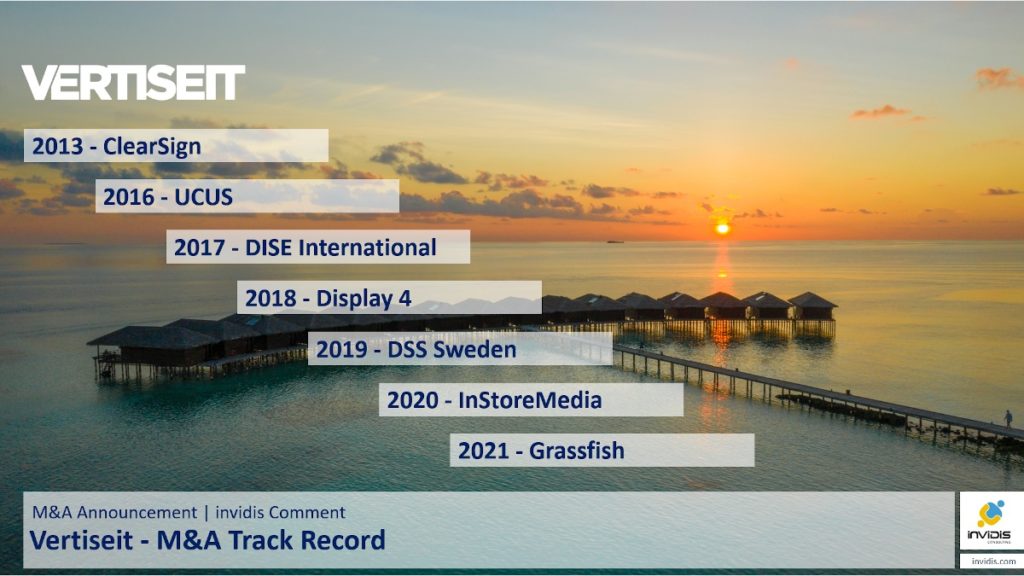

In the case of Vertiseit, in addition to the rapid growth of the company and the high number of acquisitions, the stock market probably also rewards the courage to establish with ISV+ an alternative digital signage business model. In addition Vertiseit recorded 39 straight quarters of profitable SaaS growth – almost 10 years. A great story investors like and CEO Johan Lind knows how to sell it very convincingly.

Florian Rotberg and Stefan Schieker from invidis consulting will present further indsutry analyses and insights at DSS ISE on January 31 in Barcelona. Join us for the invidis keynote and more than 30 industry speakers.