Digital Signage Market 2012: Exceeding expectations

The Digital Signage Market in Germany, Austria and Switzerland performed exceptional by growing 27 % year-on-year in 2011. Exceeding last year’s growth by an additional 6 %.

In 2011 the German economy defied the crisis in the Eurozone by creating 3 % growth in GDP. According to the Federal Statistical Office, one of the best results since the reunification in 1990 can be traced to a rise in domestic demand and investments.

Digital Signage – in the slipstream of a roaring German economy

Digital Signage – in the slipstream of a roaring German economy

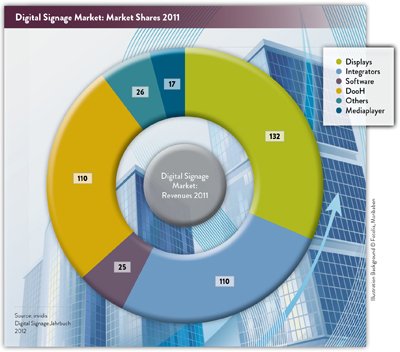

The investor friendly economy in Germany was a strong incentive for complex digital signage projects and large rollouts in 2011. This includes the POS Networks for BP (Aral) petrol stations and REWE supermarkets as well as the ongoing development of the Ströer Digital out of Home Channel. The result was a market growth of 27 %, with overall revenues accumulating to 420 million euros. Invidis forecasts the Digital Signage market surpassing the half billion Euro benchmark in 2012. The stigma of the niche market now rightly lies in the past.

Displays – driving the market

The display producers were the big market drivers in 2011. Record sales of professional displays paired with a relatively slow reclining average price per unit made up for a 32 % growth in revenues. The two big players Samsung and NEC could further increase their dominant market share from 49 % in 2010 to 55 % in 2011. However, NEC had to accept Samsung’s European dominance, falling behind in their yet strongest market. LG and Panasonic / Sanyo remained stable with a market share of 9 % respectably 8 %. The biggest winners were Philips and Sony who both could increase their revenues by over 100 %.

Integrators – big projects push big money

Digital signage integrators profited from the increase of professional projects in 2011. The Market went up from 85 million euros in 2010 to 110 million euros in 2011, managing an overall growth of 29 %. This made it possible for the integrators to retain their market share of 26 % within the digital signage value chain, proving they could keep pace with the display producers. The big three T-Systems, xplace and Seen Media drove the market, defending their positions in the ranking. Just behind them in position four and five the big winners were Intelligent Service Solutions (ISS) and Nordland Systems, both rising several places and breaking into the cluster of 5 – 10 million euros of revenues.

Software – too many fish in the pond

As in 2010 the market for digital signage software remained highly heterogeneous in 2011. In the D-A-CH region almost 120 companies were competing for a piece of the relative small cake of 25 million euros of revenues, making up only 6 % of the overall digital signage market in 2011. The few companies who could place over 10.000 active licenses on the market by the end of the year were Scala, Grassfish and mdt. The two winners of the 2011 software market were Magnetix and komma,tec who each could jump several places to surpass the benchmark of 5.000 licenses.

DooH and others – marching to the beat

According to invidis estimations the Digital out of Home market increased its revenues from 92 million euros in 2010 to 110 million euros in 2011, creating a healthy market growth of 20 %. The market for other participants like media agencies, content providers, distributors and hardware producers is valued at about 43 million Euros, which accounts to a rise of 24 % compared to the preceding year. Exclusively for 2011 invidis were able to calculate the market for media players. Coming to the conclusion that approximately 17 million euros were earned. Austria and Switzerland saw through a phase of consolidation with an increase in professional projects being initiated in the second half of the financial year 2011. Here most companies could retain their ranking, with the overall market growth managing 20 %.